- Daily SITREPS

- Posts

- Key Metrics Update for Thursday, December 15, 2022

Key Metrics Update for Thursday, December 15, 2022

It's day 1 for DCDR Research!

Good morning. Welcome to DCDR Research and our first risk metrics report.

Congratulations on being one of the first users! I'll try to not disappoint but let me know what you think of the format, the content and the overall usefulness of the report.

(If you're not sure of the methodology, check out the white paper here.)

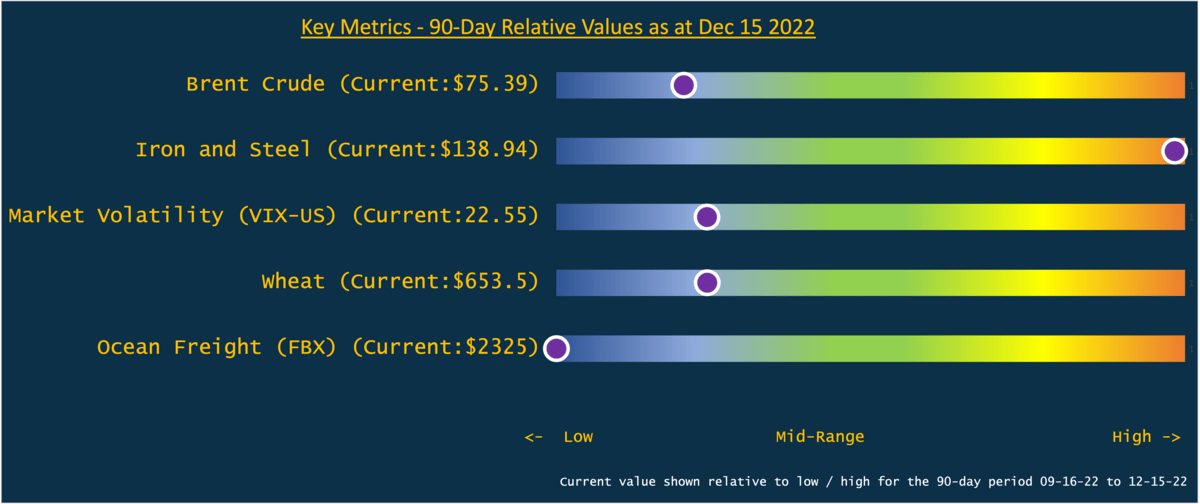

Here are the updated risk metrics as at December 15, 2022.

(Note, the values shown below are for relative comparison and trend analysis. These are not live updates on prices or values.)

Relative Values (90-Days)

Turn your phone for a better view ⟳

Trends (21-days)

Turn your phone for a better view ⟳

Commentary and Evaluation

Brent Crude

Brent Crude is low for this 90-day interval and decreased moderately over the last 21 days. These lower prices have significantly eased fuel prices and associated costs such as transportation and supply chain costs.

What to Watch

Russia may retaliate against EU oil sanctions that cap what signatory countries will pay for Russian crude by cutting production. Other OPEC+ countries may join this production cut, driving up prices.

See Reuters for more.

Iron and Steel

Iron and steel prices are very high at the moment, almost at the top of the range for the last quarter. Prices crept up again over the last 21 days after a brief lull.

What to Watch

China’s relaxation of COVID restrictions should allow the country’s construction and manufacturing sectors to swing back into action which would increase the demand for raw materials, increasing demand and prices. However, there is still uncertainty about how effective the COVID easing policies will be meaning that a manufacturing and construction boom in China may be weaker than anticipated.

See Bloomberg for more.

Market Volatility (VIX-US)

Despite a relatively low rating for the quarter, volatility in US markets rose sharply over the last three weeks reflecting continued uncertainty around the US Federal Reserve’s plans to control interest rates against a backdrop of worrying conditions that have built up over the year. (Note the Fed’s latest rate change was issued on Dec 14 outside of the data range this assessment is based on.)

What to Watch

The range of conditions facing markets and investors remains significant and complex meaning that it’s unclear what will help ease tensions and reduce volatility. Greater clarity from the Chair of the Federal Reserve will help as will the completion of end-of-year layoffs and staffing cuts. The New Year may allow a market reset where risk and uncertainty have been priced in more effectively, reducing turbulence and volatility.

Wheat

Wheat prices are relatively low for the period and saw moderate decreases over the past 21 days. Markets appear to have priced in the effects of Russia’s invasion of Ukraine and stabilized to account for the resultant impact on spring harvests and exports via the Black Sea.

What to Watch

Despite agreements brokered by Turkey, Russia is still in a position to impose a blockade on Ukrainian grain exports to exert pressure on Kiev and her allies. Moscow could also conduct military operations to disrupt spring planting meaning that prices could rise again next spring and summer.

Read more in AGWeek.

Ocean Freight (FBX)

Ocean freight is at its lowest point this quarter and prices continued to drop sharply over the last few weeks. Prices are still above pre-COVID levels but significantly lower than this time last year and appear set to continue their steady reduction.

What to watch

China’s easing of COVID restrictions should bring manufacturing levels back up. However, recessionary conditions in many countries, plus the difficulty in raising funds while markets are so unsettled (see VIX above), suggest that demand will not be high enough to place significant demands on supply chains.